Special statistics provide an insight into how Bitcoin miners see the market.

The price of the Bitcoin is of course determined by supply and demand. One of the parties that can strongly influence supply and demand is Bitcoin miners. We see a pattern based on a number of remarkable transactions. Do we see a preview of the Bitcoin price in the medium and short term? We explain.

Table of Contents

Bitcoin miners and Bitcoin price: what about that?

Since the halving, we know that the miner who mined a block first 6.25 Bitcoin (BTC) as a so-called ‘mining reward’. The miner can of course sell it. He can also decide to keep the crypto coins and thus speculate on a price increase.

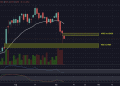

If we look at the figures for the past 24 hours, we see that the Miners Rolling Inventory (MRI) is 169.83%. This means that the miners have held 69.83% of the mined Bitcoin. As long as the MRI is above 100%, this means that miners hodle the coins with the expectation that the price will rise. So this is a positive indicator.

Miners move opposite

When we zoom in, however, we see something special. Namely, in the past 24 hours, miners mined 813 BTC, but sold 1,380 BTC. This means that the MRI is gradually being tapered.

We also see that more than 11 million dollars worth of BTC has now been brought to wallets of exchanges by the miners. In general, this means that miners want to sell. That seems in contrast to the MRI, but it is certainly not necessary.

What do these movements mean for the Bitcoin price?

As the price of the Bitcoin is now falling and the MRI remains above 100%, it seems that the miners are still confident in a price increase in the long term. However, the fact that the money is transferred to the stock exchange wallets also shows that a further fall in the price is expected in the short term and therefore also wants to cash in part. The irony is that the miners provide a self-fulfilling promise. After all, a dump of a large amount of crypto coins (and we speak of that with $ 11 million) will undoubtedly lead to lower prices.

It is therefore very much the question whether the Bitcoin her August performance can repeat. You can of course always go in the live crypto rates see what the position of the BTC or other crypto coins is exactly. Our overviews are available 24/7.

If you feel it is the right time to trade, we recommend that you get to open an account at Bitvavo. Bitvavo is the cheapest broker in the Netherlands and they now offer an attractive discount (no costs charged in the first week) when you open an account. If you prefer to trade in US dollars or GBP, then we suggest Binance, one of the most important and advanced crypto exchanges in the world.

Source: Zycrypto