Today it was a remarkable day for Bitcoin traders. After a new all-time high the BItcoin price started to decrease. According to the mainstream crypto media prices crashed. We have a different opinion. In this posts we share 5 lessons that can be learned from today’s Bitcoin volatility.

When you followed the headlines today you might have been shocked by the ‘crash’ of the Bitcoin as reported. We understand, but is this shock legitimate? Here are five lessons to be learned after today’s Bitcoin volatility.

Table of Contents

1. Beware of FUD regarding Bitcoin volatility

When you look at the price development of Bitcoin since the first of January of this year we see that, until yesterday, the price rose from $ 28.837,28 (on the first of January) to $ 56.377,64 (the all time high set on the 21st of February). At the moment of writing this article, the price of Bitcoin is $ 53.736,- and that’s equal to the price of last Friday, when the same price was seen as a sign of prosperous bullish behaviour since it was an all time high. So, what crash are we talking about?

2. Concern the snowball effect during volatility of Bitcoin

When volatility occurs there will be a snowball effect. This is caused by two automated mechanisms that will be activated.

Trading bots will take over

A lot of people use automated trading nowadays. This means that trading bots are programmed to buy or sell automatically when a certain price is met. Today that meant that a lot of trading bots have probably sold during the falling of the Bitcoin price and bought when the price of Bitcoin went up again. In this contribution you can learn more about trading bots.

(long) options are executed automatically

When traders are trading in Bitcoin options they’re using a leverage factor. In order to do so they have to pawn their portfolio of assets. When volatility increases like today, the assets will no longer be enough to cover the leverage. At such moment the exchange will execute the value of the portfolio and sell immediately to cover the outstanding costs of the trader. Therefore the availability of cryptocoins rises (since altcoins will be executed as well) which lowers the price further.

These two factors cause a snowball effect which increases volatility on short term.

3. Don’t let emotions influence your trading behaviour

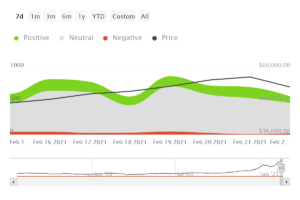

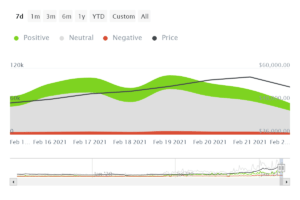

During the most volatile period the Bitcoin nosedived below $ 50.000,- which is considered a psychological barrier. However this was corrected immediately by other parties buying the dip. Since there is a scarcity due to institutional investors stepping in and PayPal users getting more and more active there are more BTC bought than mined per day. So don’t let emotions get you. When we look at the sentiment on social media like Twitter and Telegram we see that there was hardly any increase of negative messages regarding Bitcoin.

The same goes for Twitter.

4. Use on-chain metrics to take advantage of increasing Bitcoin volatility

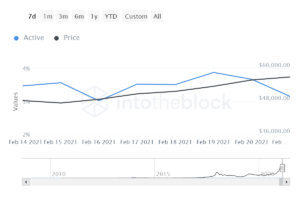

When you’re an experienced trader or want to be sure that you’re on the first row when short-term sentiments are changing use on-chain metrics. Below we share some statistics provided by our on-chain metrics partner Intotheblock that show how the Blockchain data showed a change was coming.

Based on these statistics and many more on-chain metrics provided by Intotheblock, it was clear that a change was coming. Are you curious which on-chain metrics are available for Bitcoin and other cryptocurrencies? Take a look at the site of our on-chain metrics partner Intotheblock.

5. Don’t trade during volatility when you’re not an expert

Trained investors and day traders are fond of volatility because it’s providing a lot of opportunities for multiple short-term profits. However when we consider that the price went down over $ 10.000,- and rose $ 5.000,- again within matter of hours it requires a lot of expertise to take profit of these price difference. Therefore it’s best to not trade during high volatile times when you’re not an expert.

In the end the old saying is true: “a loss is only a loss after you’re sold your assets when prices are down.”