In this post we explain what CME-gaps are, why they are important and why they are filled.

When you are focused on the price movements of Bitcoin (BTC) you will hear the term ‘CME Gap’ sooner or later. Have you ever wondered what’s meant and why it’s so important? In this post we discuss all you need to know about a CME-gap when investing in Bitcoin.

Table of Contents

What is a CME-gap in relation to Bitcoin?

A CME-gap refers to the Chicago Mercantile Exchange (CME) which offers possibilities for larger investors to trade Bitcoin options. However, where trading of Bitcoin goes on 24/7 the CME has closing and opening times.

When the price of Bitcoin moves severely between closing time of CME on one day and opening time of CME on another day, you will see a large difference between closing price (for instance on Friday) and opening price on Monday.

The space between the closing price and opening price of CME futures is called a CME-gap.

Why is a CME-gap important for Bitcoin?

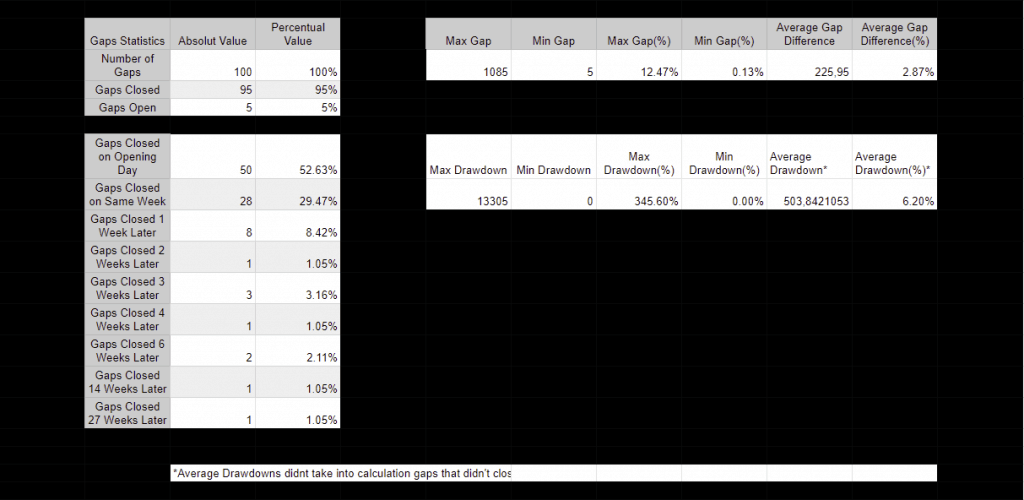

In 2019 a former Tweep by the name of ‘The Whiskey Guy’ examined 100 CME gaps which occurred since december 2017. It turned out that 95% of the CME-gaps were closed. This means that the live price of Bitcoin moved to close the gap that occurred. Only thing is that it’s not clear when the market will close a gap, as you can see in this overview.

Allthough the Twitter account of Thewhiskyguy doesn’t exist anymore you can find the complete findings of his research in this spreadsheet.

Why are CME-gaps filled?

Unfortunately it is not proven why CME-gaps are filled by the market. However, there are two common explanations which both come down to aan attempt to ‘buy the dip’.

The first explanation is that there is a relation to the monthly expiration of CME-futures. The prices lower since many investors on CME take a counter-position to secure there futures interest. When the expiration has been through the market and price is rising these large investors are suspected to force the price down to make up for their loss.

The other explanation is that the CME-gaps are a good indicator for buying the dip. So when large investors are not convinced of a bull rally they step out and wait till gaps will be closed and invest again when the price is at the bottom of the gap.

Why are we discussing this matter now?

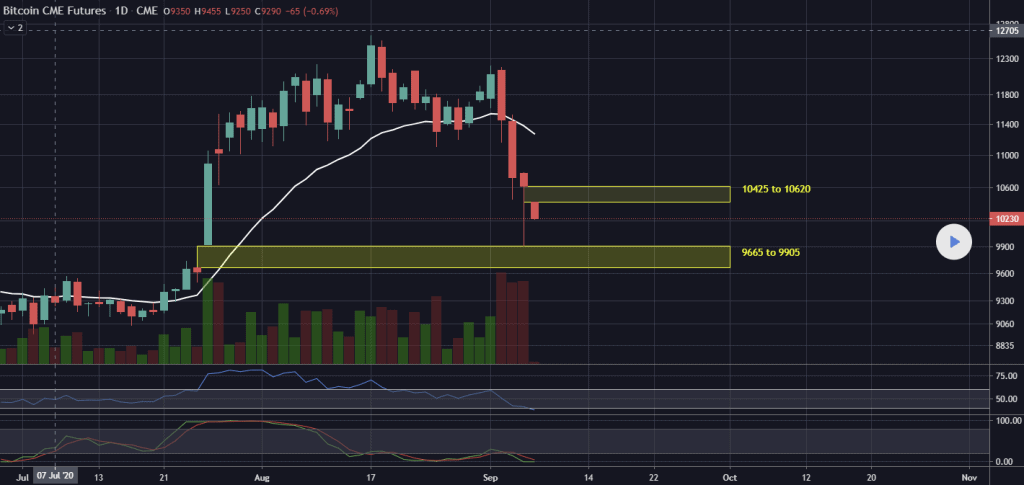

First of all are CME-gaps more and more recognised as an indicator to determine the price direction of Bitcoin. Furthermore, at the time of writing (the seventh of september 2020) we see a decline of the price after a bullish period. Investors are wondering if the open CME-gaps are going to be closed before the next bull run. In the chart below (made with Tradeincrypto.com) you see the current open CME-gaps.

Are you looking for other ideas regarding the Bitcoin price? Perhaps the ideas of the miners can bring some light. To follow the price of Bitcoin or any other cryptocurrency you can always study the live Bitcoin and crypto rates to see what the actual price of BTC or any other cryptocoin is. Our overviews are available 24/7.

If you feel it is the right time to trade, we recommend you to open an account at Bitvavo. Bitvavo is the cheapest broker in the Netherlands and they now offer an attractive discount (no costs charged in the first week) when you open an account. If you prefer to trade in US dollars or GBP, then we suggest Binance, one of the most important and advanced crypto exchanges in the world.