How comes Tether (USDT) is getting attention when Bitcoin (BTC) gets volatile? We explain.

When investing in Bitcoin (BTC) it won’t take long before you’ll get familiar with Tether (USDT) as well. Why is that and what is the relation between the two cryptocoins? We’ll explain and tell you what to look for to trade more successfull.

Table of Contents

What is Tether (USDT)?

Let’s begin with the basics. Tether is a so-called ‘stable-coin’. This means that the value of this coin is stabilized since it’s connected to another asset (in this case the US Dollar. That means that each Tether bought is backed by the equivalent of the value of 1 US dollar. To be sure, this does not mean that for each Tether (USDT) issued, one US dollar is held. The counter-value is determined by various other assets which have a combined value of 1 USD per Tether.

This means that there will be no large increases or decreases in price. Therefore the rate is stable and a safe haven for investors when the market becomes volatile. The interest on liquidity on exchanges however, can be very interesting with an all-time high of 19%. If you want to know more about Tether (USDT) please visit our coin-page, where you can find all sorts of relevant information.

Why is Tether (USDT) relevant for Bitcoin?

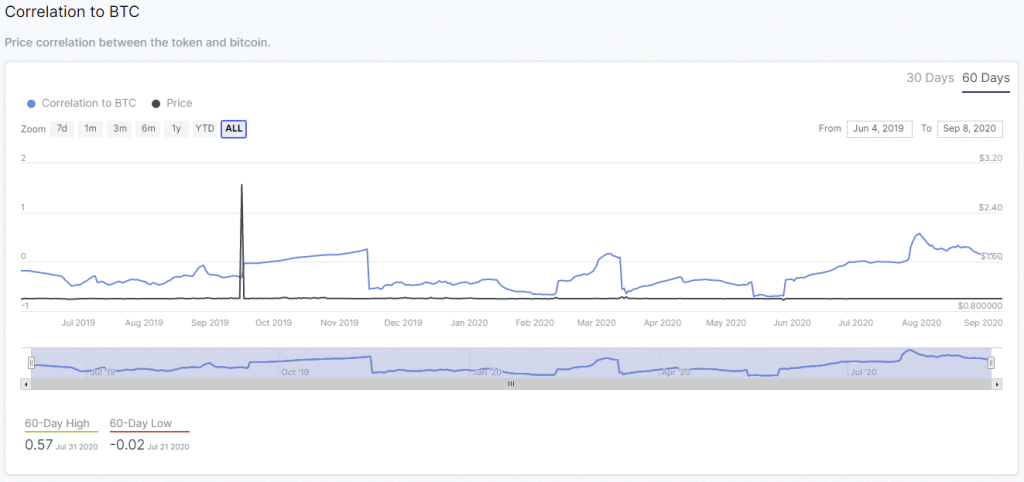

When we look at the regular correlation, we see that at first hand, there seems to be not much relationship between the two coins. This you can see in the chart below.

However, a study showed that there is an inverse correlation.

What’s the inverse correlation between USDT and Bitcoin (BTC)?

It turns out that traders are responding to a volatile Bitcoin by making use of Tether (USDT). When the price of Bitcoin starts to go bearish they sell their Bitcoin. When they don’t want to leave the cryptocurrency-market in full they convert to USDT and wait until the market gets better. At that moment you see USDT be transferred from exchange wallets to private wallets.

When things start to get better it’s the other way around. Experienced traders will move USDT to exchange wallets. By doing so they are ready when they consider it the right time to buy Bitcoin again at the dip.

How can you profit from the inverse correlation between Bitcoin and Tether?

When the markets get volatile it’s wise to be very careful and trade as less as possible. However, when you do your own research and notice large amounts of Tether are moved from or to exchange wallets you can use other statistics to see if these movements are in line with other analytics. Of course always be aware of a Bull-Flip.

Curious about the current price of Bitcoin and other cryptocurrencies? Take a look at our live cryptocurrency exchange rates.

If you feel it is the right time to trade, we recommend that you get to open an account at Bitvavo. Bitvavo is the cheapest broker in the Netherlands and they now offer an attractive discount (no costs charged in the first week) when you open an account. If you prefer to trade in US dollars or GBP, then we suggest Binance, one of the most important and advanced crypto exchanges in the world.